At a time when many entrepreneurs feel the domestic financing environment for cooling, domestic VC is simmering, and even a new "challenge", academia is compared to one of concern. He officially announced in the near future from IDG to leave, Feng Rui, founded a new investment agency capital (Frees Fund), claimed to change the traditional VC.

Opinion in sci-tech VC community is prominent, of sorts. Early had founded "seconds system" (currently still normal running), 2008 joined IDG capital became most young of partner, has in five big field expand "theme investment", respectively is electric business (Han are clothing homes, and three only squirrel,), and Internet financial (should be letter, and Prosper, and copper Street, and dug fiscal,), and after the lifestyle (face MoE, and with sing,), and Internet content platform (Bilibili,) and O2O of C2C (pig network, and Beaver home,). In reviewing investment career, he summarized as follows figure: 7 year investment of 61 companies, $ 1.797 billion return on invest US $ 292 million in overall book return 6.14 times times. That investment banking is a good achievement in China.

But even so, he left the famous IDG, wanted to use both hands to build from scratch a new investment bank. The opportunity for change in his eyes where? and in what way to implement? the evening of August 16, peak outside the Swiss capital to uncover the true veil. Opinion also describes the progress of the company, as well as the team sees opportunities.

On understanding Feng Shui capital before the specific rules of the game, first understand the basic business model of the traditional VC industry. VC funds get LP (investors) funds, management fee revenue models are mainly 2% and 20% Carry (return on investment), all remaining 80% by LP. In the midst of this, 20% occupied, mostly by partner shares to split. To the General Fund, unless an earlier partner occupies a certain percentage of shares in addition to late-entering senior staff and almost impossible to enjoy large gains, or even most people sit or paid.

Despite the opinion I did not disclose within the IDG's stake, but its 2008 and 1992 IDG China into the company by comparison, the shares Carry the proportion should not be too high. Industry is another scene of domestic LP many, relatively easy to raise new funds, or can't figure out I venture a motive. Before that, former partner of Sequoia Capital Vice President Cao Yi, Gobi Tong Wei, formerly IDG capital partners Zhang also founded the source capital, plane trees and Rong Gao capital, and have achieved good results.

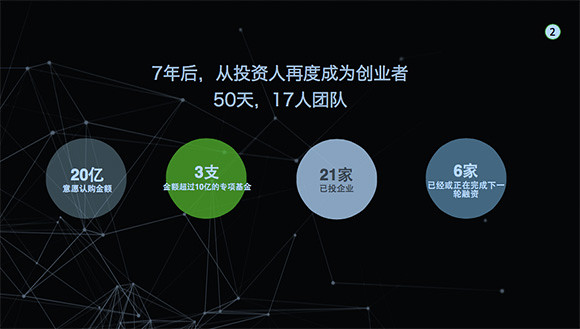

To understand peak of the Swiss capital is currently under progress:

As of August 16, the company set up a 50-day, 17-member team, there are 3 funds, has invested in 21 companies. $ 150 million initial fund size expected + 1 billion yuan.

Orientation, peak Swiss capital early to early-stage Fund, investing in the Internet early in the project, and we hope this themselves fair and transparent way, to break through the old and outdated rules of the Fund.

Specific practices for LP, respectively, adjusted profit distribution rules:

1, betting agreement with the LP: the current VC industry most of mode of +20% Carry 2% different, Feng Rui capital costs according to different stages of the return. If the investment return is less than 3 times, peak-the Swiss capital will not charge management fees 2%, only 20% Carry;3-5 times the return on investment, in addition to 2% management charge, Carry up to the 25%; is more than 5 times return, will Carry up to 30%. Dare to bet against, on the one hand is based on the project's operator, on the other hand is a lot of hot money when LP, take money with relative ease.

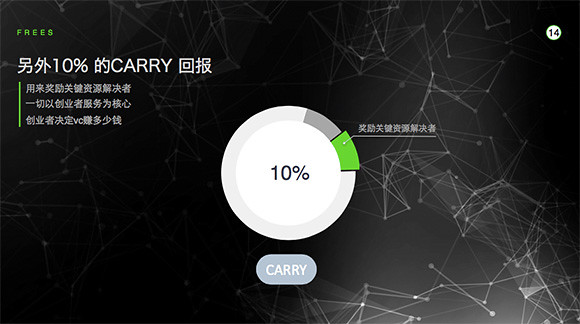

2, the distribution is no longer limited to Carry internal and partner: breaking the single distribution mechanism, making external references, entrepreneurs can also participate. 20% Carry to, for example, 10% of the part can be divided by the referee and the Executive team, if it is a result of investment, external referral, project 5% Carry is available, the Executive team for the remaining 5%, Fund insiders (LP/investment company/base ⾦ management team) after investment, get the project 8%, and ⾏ team 2%. For 10% Carry referred to entrepreneurs to do assignments, reward for key resources and solutions.

Over the years dig what great letv executives

3, lowering the threshold LP: setting ⾄ reduction of threshold for QFII RMB 1 million Yuan (US $ 200,000), the total quantity does not exceed 200.

4, open investment and skills service platform: cast service after all section team leader in career paths can also be based on ⾦ Gold partner ⼈ people; business team members to participate in the allocation to Carry.

5, using technology to improve services: opinion on this for the time being did not disclose details, but left a Easter egg is expected to launched in October.

From information overall, the peak of Swiss capital game is targeted to improve existing VC multiple disadvantages, and looked forward to a more encouraging measures to ensure all parties benefit, optimize distribution, cover the funds GP, LP, an investment group, the Fund staff, entrepreneurs, etc. Key word, "the giver".

Opinion in the speech at the end, disclosed that this sentence is very interesting and worth the wait, "we not only want to do ⼀ an investment base ⾦, stories and dreams we have only just begun. "

No comments:

Post a Comment